Is Space Situational Awareness The New Gold Rush of The New Space Economy?

In May of 2023, LeoLabs, a leading global player in Space Situational Awareness (SSA), detected a Chinese spacecraft believed to be a spy spaceplane in Earth’s orbit. The identification and analysis of the spacecraft’s maneuvers by a private SSA company not only emphasizes that space is no longer an environment where anonymity is possible but also underscores the increasing importance of SSA capabilities for safeguarding nations across the globe.

SSA is much more than just space surveillance—it represents an essential pillar for the safety and sustainability of our presence in space. SSA addresses a variety of major needs and concerns related to space sovereignty while simultaneously opening the door for exciting new perspectives on the management of the space economy.

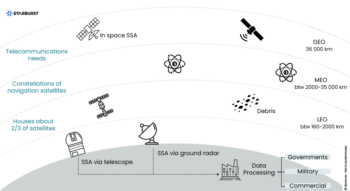

Monitoring and tracking objects in orbit, whether space debris or active satellites, is crucial to assess collision risks, predict trajectories, and protect critical space infrastructure. At the same time, space traffic management is essential to avoid orbital congestion. Coordinating space launches and organizing orbital locations are key aspects to ensure smooth and secure space operations.

Each orbit has a distinct way of being observed:

- Radars (spatial and ground-based) have a typical range and effectiveness of up to 2,000 km. While detection radars exhibit high precision and reliability, they come with significantly high costs and are susceptible to weather conditions, atmospheric disturbances, and the persistent challenge of consistently tracking objects.

- Orbital Telescopes are designed for observing higher distances, yet they face limitations in terms of resolution, field of view, and technological constraints.

Consequently, there is a noticeable shift towards adopting space-based surveillance technologies by employing satellites to monitor and observe orbital activities.

SSA actors have specific needs for the surveillance, security, and management of space activities:

- National Space Agencies, which are responsible for the deployment and management of government-regulated satellites, have a top priority of protecting their space assets. This requires constant monitoring to anticipate the risk of collision and guarantee the long-term sustainability of their spacecraft in orbit.

- Armed Forces rely on space for strategic communications and surveillance operations, thus enabling them to monitor and protect their satellites from potential threats, including those related to anti-satellite attacks.

- Private Companies, including satellite manufacturers, operators, launch companies and space service providers, must protect their investments, maintain the readiness of their satellites, and ensure the safety of their missions.

The global SSA market is becoming increasingly attractive for these type of stakeholders, particularly in light of space witnessing a surge in the number of satellites, actors and missions. Thus, this trend is prompting a need to address more challenges and use-cases.

Presently, the main customers for SSA are government agencies. Data and services hold potential for commercial transactions with governments, satellite operators, space launch operators, satellite manufacturers and insurance companies. For instance, Canadian company NorthStar Earth & Space has raised $35 million in funding, led by Cartesian Capital, for a constellation project. In Europe, German startup Vyoma raised $9.2 million to develop satellites to monitor space debris.

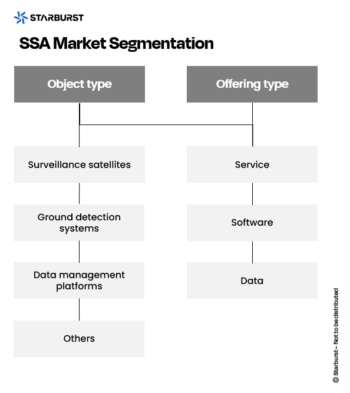

In the current value chain, operational business service providers are not included (i.e., software vendors, command and control systems, ground systems and sensors). However, key steps for SSA can be broken down into five main activities: collect, characterize, catalogue, process and act.

Today, governments and their affiliates operate on distinct terrestrial and space systems. However, as our presence in space expands, a pivotal moment will arise necessitating international consensus for effective space surveillance. In the short term, situational awareness management will likely rely on national programs and/or collaborative efforts. Thus, SSA transcends mere surveillance; it emerges as a fundamental geopolitical element, ensuring the safety, sustainability, and prosperity of space operations.

In this context, data and its precise characterization are key to the future of space exploration. Real-time data collection is essential to assess the positions of orbital objects, predict movements and potential interactions/collisions, and enable informed decision-making to avoid hazardous situations.

The role of data within the domain of SSA helps us to better understand and explain the space ecosystem by developing long-term management and preservation strategies for outer space. As such, the issue of data ownership is a subject of concern. It is apparent that the value assigned to data will shape the trajectory of the future of SSA.

Below are three prospective scenarios in which the role of data is determinant:

- A unique, high-value currency: data with high commercial value but that is monopolised by state structures

- SSA data as a strategic lever: a power-play tool; an advantage for the international scene

- Data as a commodity: data becomes accessible to all; the added value is derived from its associated services

- A unique, high-value currency

Data is essential for SSA, and its place in the value chain makes it a strategic component. In today’s global landscape, the majority of data is controlled by states or affiliated entities, driven by various considerations.

- Primarily, data serves as a valuable asset in exchanges between partners, regardless of their nature or role. It remains true that the owner can use the data in a way that suits them the most (i.e., by selectively disclosing results, manipulating parameters, or even denying its existence altogether). States in control of such data also hold the authority to disclose information about the existence of their strategic military satellites.

- On the other hand, data also represents a palpable means of economic enrichment. The scarcity of the number of data owners and unclear regulations favor a competitive model in which the economic value is determined by the operator. A notable example is the May 2018 announcement by the Trump administration regarding the transfer of services from the Combined Space Operations Center (CSpOC), previously under the Department of Defense (DoD), to the Department of Commerce (DoC). Additionally, while SSA observations are recorded and cataloged, the United States’ public “space-track” catalogue stands out as the most comprehensive. These services position the U.S. SSA as an international benchmark, potentially making space surveillance a closed and exclusive market with high profitability.

2. SSA data as a strategic lever

Data could also serve as a lever of sovereign control, and consequently, a tool for exerting pressure. This subject is gaining increasing strategic importance as it confronts numerous significant challenges in the realm of national security, including:

- The weaponization of space, with the deployment of weapons in orbit (i.e., lasers, anti-satellite missiles and/or hostile satellites). In other words, these are weapons that can directly threaten vital infrastructures.

- Dependence on space systems, for communication, navigation and observation, deems states vulnerable in terms of anti-satellite attacks, cyber interference, space debris and collision.

- Massive economic losses and social consequences could result from service disruption in space.

Currently, few countries possess the capabilities to develop their own autonomous SSA system, such as the United States, Russia, China, India, and France. It appears challenging to envision every country establishing its own fully functioning operational system, primarily due to issues related to funding, research, and the availability of resources (like materials, launch sites, and expertise). Within this select group of system holders lies the inherent value and geopolitical advantage of SSA data, particularly in the content of negotiations and agreements.

It is possible that the US, being a frontrunner in SSA capabilities, could establish new norms and standards by limiting their free Combined Space Operations Center (CSpOC) services (such as daily alerts to operators whose satellites face collision risks). This could indirectly force all operators to comply with these standards in order to access crucial US SSA data. One can even imagine a major alliance between the American government and insurance companies, tactically pressuring their clients to comply with these emerging standards.

3. An accessible and common commodity

The reduction in barriers to entry in the space sector is paving the way for emerging private companies. These entities already offer surveillance and tracking services, specialized technologies, and space debris management solutions. There is also a collective belief among them that the existing telescopes and radars will require additional support to meet future demand, representing untapped opportunities for SSA market.

Forecasts for both space and ground systems indicate substantial growth, projecting the market to grow from $82 million in 2022 to approximately $1.4 billion over the next decade. To tap into this expanding market, private players must prioritize data accessibility, with added services becoming the key determinant of their value proposition. To achieve this, they can consider:

- Cost reduction and partnerships. One of the key actions to making SSA data more accessible is to bet on low-cost solutions. To do such, emerging companies can turn to less expensive space access solutions (i.e., hardware, technologies, a reliance on mega-constellations etc.). They can also think in terms of partnerships with solid and well-established infrastructures such as SAFRAN (like in the example of Vyoma), investment funds or groups such as ArianeGroup, Eutelstat and Magellium. In doing so, they can benefit from the players’ assets, expertise, materials, and resources to streamline the main developments of their offers.

- Qualitative baseline data as a nerve center for SSA, holding significance for both private actors and public institutions. The higher the quality and security of this data, the more confidently players can rely on it to develop value-generating ancillary services, thereby relegating the value of the data to the background. To address these concerns, the European Union initiated its European Union Space Surveillance Tracking (EU SST) program in 2014. Administered by the European Commission, this program aims to promote operational cooperation between member countries [1] for collision avoidance management, atmospheric re-entry analysis and debris fragmentation analysis. The program contributes to safer and more secure space operations, benefiting both government and commercial entities dependent on space assets. In doing so, EUSST promotes innovation and technological advancements in the sector, potentially leading to the development of new solutions and services for the market.

With the proliferation of initiatives like these, data is poised to become more accessible, ushering in new economic opportunities. Therefore, the value will be embedded in the services associated with the data rather than the data itself.

In summary, the future of SSA hinges on the structural significance of data, drawing parallels with what has happened in the Earth Observation (EO) sector.

Today, the EO market has opted to work with mainstream data that is widely accessible to all, particularly through projects such as COPERNICUS or NASA’s Earth Observatory, which allow new entrants to use the obtained data on a self-service basis. The collection of data by public projects for private companies as end-users is one of the evolution scenarios for SSA. However, initiatives like the EU SST encounter challenges due to a combination of member capacity limitations and a constrained budget. Drawing parallels with the example of the EO sector, the expense associated with accessing data continues to impede the advancement of mainstream economic activities. In addition to this, the lack of homogeneity in the SSA environment, coupled with the unclear regulations, hinders the establishment of a common basis for all relevant players.

We find ourselves at a pivotal moment for SSA, one that is characterized by considerable uncertainties surrounding the outcomes and key dynamics. At the very least, the undeniable technological challenges it presents will enable us to investigate its diverse applications and uses, ultimately exerting a major impact on the evolution of the SSA sector.

—

[1] Austria, Czech Republic, Denmark, Finland, Germany, France, Greece, Italy, Latvia, Netherlands, Poland, Portugal, Romania, Spain, and Sweden.