The Ecosystem’s Flight Plan: Reshaping the Future of Aviation

Decarbonizing aviation is undoubtedly the greatest challenge that the industry has encountered so far. It is under increasing pressure to lower its carbon footprint and align with the 1.5°C target set by the Paris Agreement. This topic was front and centre of the Paris Air Show in June, with daily announcements from all the major players. However, there was limited clarity on the time horizon and the range of the potential adoption & deployment at a global scale.

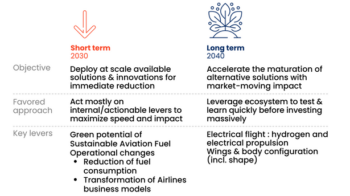

Looking at options to decarbonize aviation at scale, the short term and long-term solutions need to be separated as they require fundamentally different approaches.

Short term stakes rely on reduction rather than decarbonization

Three major levers can be considered for immediate emission reduction, considering current maturity and ability to scale on a (reasonable yet optimistic) 5-year window, considering industry cycles:

- Technological improvements: To mitigate the effects of aviation on climate, the most natural option, if not the easiest, is to work on what we currently master. By that, we essentially mean to reduce fuel consumption through several optimization processes, which will result in a direct carbon emissions reduction.

These processes fall under the category of technological improvements, and usually include improved aerodynamics (optimization of aircraft shape), lighter components and higher energy efficiency. Beside the environmental benefits, airlines could have direct interest in pursuing this strategy, as fuel costs are not only one of their largest, but also most variable expenses. Likewise, aircraft manufacturers should naturally follow the strategy: a plane that has a lower fuel consumption will be easier to sell.

- Trajectory optimization: New softwares adjust the aircraft’s flight trajectory based on changing wind conditions during the ascent, cruise, and descent phases. The end goal is to use wind in favour of the aircraft and eventually save fuel. For example, Safety Line announces up to 15% in savings. Transavia, a low-cost company, has already reduced their consumption per flight by 5% thanks to Safety Line.

- Ground operations: Ground operations – which encompass every aspect of aircraft handling at airports, from onboarding management, luggage handling to plane refuelling – as well as taxiing – which correspond to the plane movements on the runway – can be also improved. In fact, electrification can have a significant impact in these cases: we estimate that electric taxiing could cut ~3,6t of CO2 emissions per flight for a twin-aisle aircraft, and ~0,8t for a single-aisle aircraft, reducing up to 40Mt of CO2 per year. These efforts can be teamed up with shorter taxiing: reducing waiting time on the tarmac by increasing waiting time at the gate would decrease emissions and make a significant difference. However, new taxiing standards would need to be implemented worldwide.

- SAF: The Sustainable Aviation Fuel is a promising lever, as it has the potential to reduce lifecycle carbon emissions by up to 80%. Its a “drop-in” technology – meaning it is ready to be used in the existing fleets – making it usable on the short-term. Still, it can lack consistency in its fabrication process and has currently a low supply capacity – accounting for less than 0.1% of aviation fuel in 2019.

Overview of main reduction levers and current maturity

Zoom: Embrace Sustainable Aviation Fuel: make the most of the only available solution?

- Exploit only the green potential of SAF…

Sustainable aviation fuels (SAF) production process is either based on the decomposition of organic material or on carbon capture. The main advantage for both methods is that the process is, on paper, CO2 neutral since it only emits carbon that was previously in the atmosphere and momentarily captured by plants.

However, the production and transportation of Sustainable Aviation Fuel (SAF) require energy, hence losing its CO2 neutrality. In the European Union (EU), SAF lifecycle emissions should be at least 50% lower than those of gasoline or diesel, so it that remains beneficial for climate. However, legislative standards can vary, and in California, the requirement is only a 10% reduction in emissions compared to conventional fuels.

The origin of SAF, which impacts its lifecycle emissions, also raises ethical concerns: if the 2nd generation of SAF does not rely on food resources at all, the 1st generation does. As a result, SAF can have very little – if any – positive impact: in 2022, a US study suggested that corn-based ethanol was worse for the climate than petrol.

If some types of SAF do not offer the expected benefits, new optimized processes that use less critical resources like domestic waste (2nd generation) and algae (3rd generation) increase its sustainability and ethics. In the aviation versus climate dilemma, SAF is now considered as the number 1 solution on the short-term, and needs to scale up rapidly.

… And boost demand to make it available and at a more competitive price

On paper, different stakeholders perceived high opportunity offered by the technology: the Clean Skies for Tomorrow Coalition has the ambition to reach 10% of global jet aviation fuel supply by 2030. Rival airlines, aircraft manufacturers, fuel producers, airports and corporate buyers have teamed up within the organization.

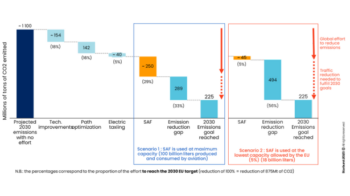

However, the current initiatives are not enough: to reach the EU’s 2030 intermediate goal on carbon emissions without reducing air traffic, we estimate than an approximate 140 billion litters of SAF are needed – and yet, SAF production is expected to deliver not more than 19 billion litters in 2030. In fact, there is a significant gap between public support for SAF and public reduction goals: the EU, through the European ReFuel Aviation will require fuel supplier to incorporate 6% of SAF into their kerosene blends by 2030 – although more than 100% would be needed to meet EU 2030 targets on emissions (see figures 5 and 6).

Finally, SAF suppliers lack a strong demand signal to increase production and start benefiting from economies of scale and learning curve effects. Public institutions have a direct role to play to increase demand significantly: offer money incentive to fuel suppliers that want to incorporate more SAF than required. Airlines can also involve passengers in this process by proposing to pay for an extra charge to increase the percentage of SAF used.

Our projection of the available solutions shows that even on optimistic scenarios for SAF which in this case is the best candidate to reach emissions goals, there is still an emission gap of ~431 MteqCO2.

Scenarios of emission reduction based on SAF adoption – Worldwide

Other alternatives that need to be explored to achieve the ambitious reduction targets

As such, the industry needs to explore further reduction levers, that might require unconventional approaches and that could transform the airlines business models as they stand today:

- Reduction of first and business classes constitute a powerful lever to limit the reduce the emission gap to reach the 2030 goal: we estimate that suppressing upper classes could reduce CO2 emissions up to 250MteqCO2, lowering the CO2 emission gap by 58%.

- Limiting the expansion of low-cost companies, which account for the majority of air traffic growth, is to consider. In particular, further limiting the number of slots for low-cost airlines, even in major cities’ secondary airports where they mainly operate (such as Beauvais airport for Paris, Bergamo for Milan or Luton for London) could be a first step. Another step would focus on implementing a minimum price for tickets.

- Virtuous financial incentives could also help airlines cut upper classes, as well as stabilize or even reduce operations. These incentives could be financed with carbon compensation paid by airlines which do not comply with climate requirements.

- Regulatory frameworks remain the most efficient way to reduce or limit air traffic: a quick look at Amsterdam Schiphol’s traffic evolution reveals that, apart from the COVID-19 pandemic, the only instance of traffic reduction occurred through a regulatory framework implemented by the Dutch government, which should take effect in late 2023.

Looking ahead, promising solutions on the long term

Short terms solutions are within our reach, however the complexity to scale and the projected impact call for an acceleration of long term decarbonation options, to shorten time to scale.

We believe that major breakthroughs and new business models are being built today, and they will require continuous efforts within the coming 10 years before they bear their fruits. However, as the NewSpace development has shown, the players that emerge the fastest from this “maturation” phase could have a definitive edge on the market.

The Ecosystem’s Flight Plan for effective decarbonation

Corporates and startups are driving long term changes with ambitious projects on hydrogen and electrical propulsion (Airbus ZEROe, Zeroavia H2-electric plane…) or shape redesign (Boeing Sustainable Flight Demonstrator…). Because of different maturity levels and capabilities, they are following complementary approaches and methods. Leveraging this disparity is key to accelerate the industry transition:

- Start-ups can help legacy players shorten their development cycle by leading the way of rapid testing

- Knowledge and capacity transfer from industrials to startups is crucial to reach industrialisation and high production level

Our experience on comparable large industry-wide transitions, including NewSpace, shows that collaboration with external players of the ecosystem is crucial to navigate and conquer such challenges, as well as reducing its associated cost.

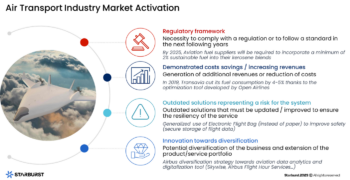

Bear the cost of change

Cutting emissions should constitute the main reason for change, despite the potential hefty investments required: every industry will have to embrace the transition at some point. Considering the extensive development cycle of the aerospace industry, starting now is a must. Yet, the Air Transport Industry can still be very reluctant to bear these extra costs: players, especially airlines, are making tight margins and might opt for new solution or change their approach only if it satisfies one of the following four conditions (see figure 2).

Description of the four conditions that would activate adoption from the Air Transport Industry

If players can be compelled by a regulatory framework (policies, compensation vs penalties…), the solution can also be voluntary adopted when it generates a positive ROI. In the last case, players frequently invest in new solutions following a strategy of diversification. This vision can be fuelled by making the most of the wide diversity of players within the aviation ecosystem: corporates can benefit from small players expertise and innovative methods to accelerate innovation/diversification while startups can enjoy the capacity to scale up.

Change your approach to accelerate your time-to-market

Start-ups tend to adopt a test & learn approach, borrowed to the Agile methodology, to test their solutions only after few months of work, while large corporations are looking for more refined solutions before first demonstrations, meaning fewer test iterations.

The test & learn approach has three main benefits that are especially relevant for Aviation players, as they require important upfront investments, risk management considering the programs time horizon (5 to 15 years) and high safety standards:

- Reduction of development costs through early troubleshooting

- Better fit to market through short feedback loops that help adjust the product roadmap progressively

- Higher quality and stability of final product through continuous testing and integrated support, leveraging operational experience from deployed products

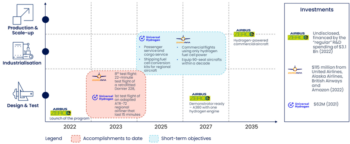

For example, Boeing and Airbus have announced their goals on the development of hybrid aircraft, but they have not conducted tests yet, while ZeroAvia did (8 test flights).

Project roadmap of the three main players positioned on hydrogen propulsion solution

Capture value from collaboration with startups

Made of heterogeneous players in term of capabilities, the aviation ecosystem can play a huge role to unlock the potential levers for decarbonation. As a matter of fact, variance in ability enhance collaboration between players because they can hardly be in competition.

- Transfer technological knowledge to startups to benefit from a solution that will fit your products when ready

This approach involves sharing technical know-how, insights, and resources with startups to gain, in exchange, the advantage of potential breakthrough innovations that complement a company’s product offerings. This collaborative effort fosters a mutually beneficial relationship, enabling companies to stay at the forefront of technological advancements.

For example, the hydrogen fuel cell technology of ZeroAvia will be combined by MHI RJ with Mitsubishi designs, certifications, and support expertise under the terms of a Memorandum of Understanding announced in October 2021. MHI RJ will provide engineering support for the installation of hydrogen systems on both new and existing Mitsubishi CRJ aircraft. As a result, ZeroAvia gained more ground in the market for regional jets.

- Mitigate internal risks by leveraging the expertise of startups specialized in niche areas

To face uncertainties of internal R&D developments in niche areas, relying on external resources of specialized players can be an interesting alternative to de-risk your projects.

Viridos is an example of a start-up that focuses on a niche area: enhancing the productivity of algae for biofuels. It involves understanding the genomics of algal physiology, developing genome editing technologies, and increasing algae yields. The results have been promising: they have achieved a seven-fold increase in bio-oil productivity compared to natural strains in an outdoor real-world setting. The relevance of algae for SAF is supported by a 2016 study, demonstrating that algae fractionation processes can produce renewable diesel fuel with significantly lower GHG emissions (63%-68%) than conventional diesel. In 2021, Viridos signed a joint development agreement with ExxonMobil, building upon their previous partnership under the name “Synthetic genomics.” The new partnership aims to scale biofuel production from SAF, further advancing their mission.

- Help increase the startup production capacity to benefit from it when it is at scale and at a lower cost

As a more traditional approach considering startups economies of scale, companies could directly benefit from higher production capacity to get more supply and at a lower cost.

Velocys, in collaboration with British Airways, aims to establish by 2027 a plant that makes sustainable aviation fuel (SAF) from domestic waste in the UK. This type of SAF is approved for commercial aviation worldwide and can be blended with conventional jet fuel up to a 50% ratio. Additionally, Velocys has partnered with Toyo Engineering Corporation to develop a biorefinery in Japan for SAF production.

- Expand your product portfolio with green solutions acquired externally

Acquiring green solutions externally offers faster implementation, however it bears a cost premium as well as additional risks on integration.

For instance, SITA chose to expend its existing suite of airline and airport solutions with the acquisition of Safety Lin (mentioned before): Sébastien Fabre, CEO of SITA FOR AIRCRAFT, emphasized the successful transformation of research into real-life applications by Safety Line through strategic partnerships with airline customers like Transavia and Air France, as well as airports like Group ADP.

As we explore the realm of aviation, it appears clearly that start-ups play a pivotal role in shaping the future of aviation. Because they possess the agility, creativity, and disruptive potential necessary to challenge set standards, established aviation players have everything to gain by working with start-ups. Yet, the urge to get solutions that have an immediate impact requires us to look at the available solutions and their associated challenges.

We understand the primordial role that startups play on their own when legacy players like Boeing have given up on hydrogen and electrical technologies for financial constraints. Thankfully for climate, many other major players are embracing startups’ potential: Safran chose to do it with its Explore H2 Program. Its goal was to discover and engage with visionary entrepreneurs worldwide who are at the forefront of developing advanced technologies for decarbonizing the aviation industry. Among other things, innovators were provided with an opportunity to enhance their technologies through dedicated Proof of Concept projects and collaboration with Safran.

The ecosystem plays a prominent role in shaping the future of aviation: we explored multiple ways that exist to take concrete actions. Airlines, OEMs and airports have paved the way for technological innovation in the past, but today’s more complex, increasingly digital and interconnected world calls for fresh new approach, and we believe that only ecosystem builders will manage to deliver breakthroughs to ensure the prosperous future of this industry.