The Unicorns Have Arrived

The age of billion-dollar aerospace startups is here.

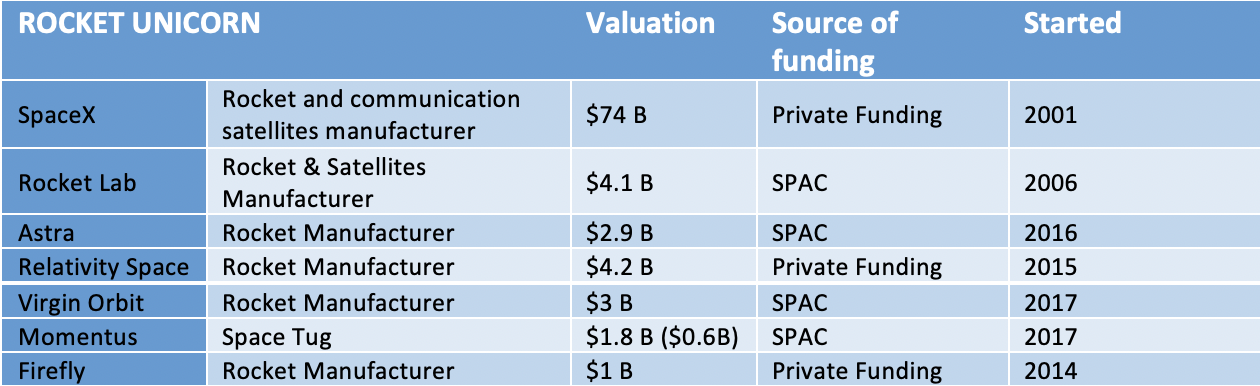

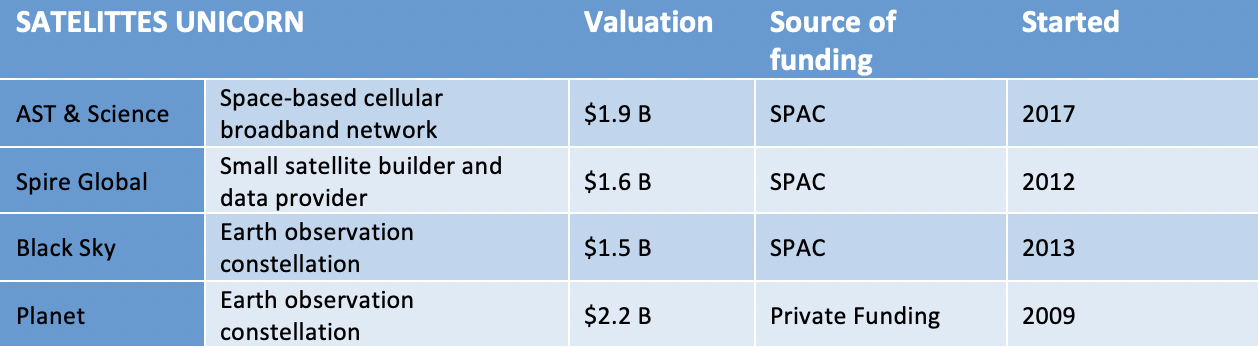

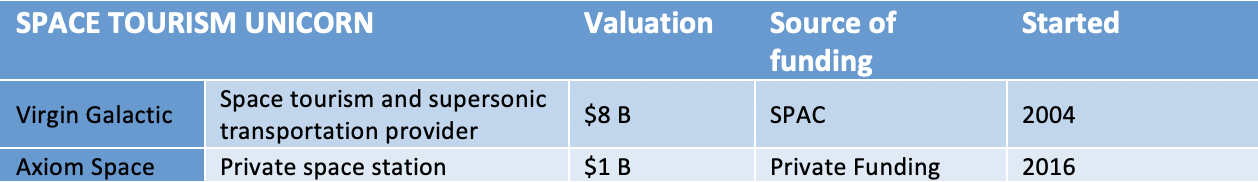

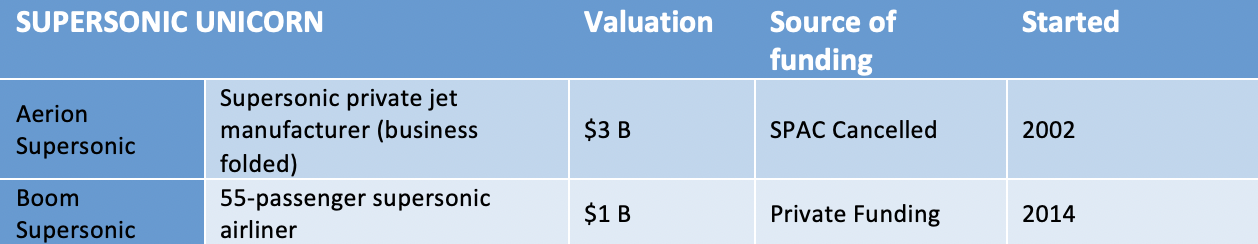

Aerospace has long been one of the largest and most powerful global industries, comprised of space, aviation, and defense markets, and — until recently — the big names hadn’t changed much over the last fifty years. In the last 12 months, however, we’ve seen more than 20 aerospace startups evolve from “early-stage” to unicorns, through either direct listings, SPACs, or late-stage private funding rounds.

Following the first Uber Elevate summit four years ago in Dallas, we wrote an article for TechCrunch where we stated the next unicorn would come from the aerospace industry. At the time, only SpaceX and Planet had earned that title, but the writing was on the wall.

In the ten years since we founded Starburst, the world’s first and only global aerospace accelerator, we have gone from incremental to industry-disrupting change. Advances in manufacturing and computer processing have greatly decreased barriers to entry, agile startups have thrived in the competitive market, and investors are hungry to capitalize on this new global space race and the technology driving change across the transportation sector.

Cutting-edge, disruptive companies can now grow into successful commercial enterprises.

If we look back on the past year in more detail; more specifically the most recent three months, valuations of aviation, space, and defense companies have skyrocketed — literally.

There are several key takeaways from the growth we are witnessing:

Aerospace has become a very attractive market: for entrepreneurs and private investors.

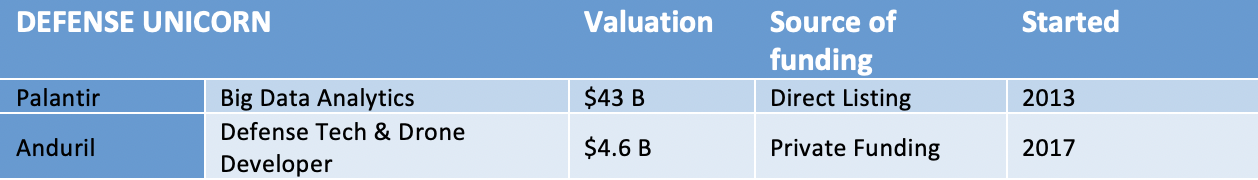

There are now more than 26* publicly traded, or soon to be in 2021, “startups” with a valuation over $1 billion each. These new players represent a combined total valuation close to $200B. Compared to Boeing’s market cap today which is roughly $130B and Airbus’ at $90B. SpaceX and Palantir make up a large portion of that $200B, but others can and will reach those numbers.

When we started Starburst, there were only a handful of new companies coming to life per year. Today, our team is scouting more than 3,000 new startups every year, predominately in the US, UK, and Israel, but also in countries like France, India, Singapore, Korea, and Japan, whose governments are increasingly investing in the sector.

Space is not only sexy but critical for understanding our own planet: we will continue to see successful tech entrepreneurs with deep pockets launching aerospace businesses.

Aviation is just as hot as the space sector.

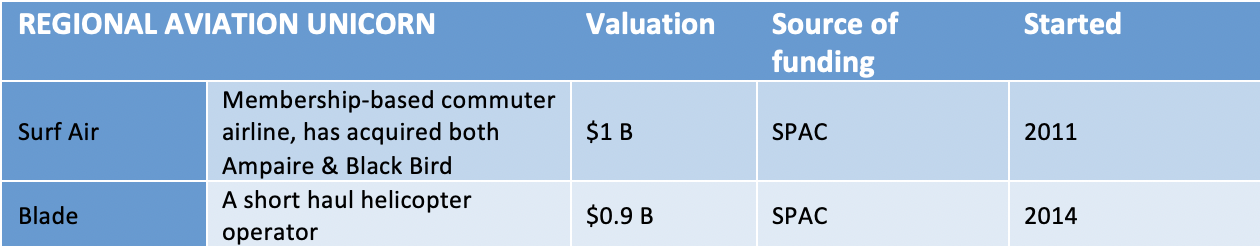

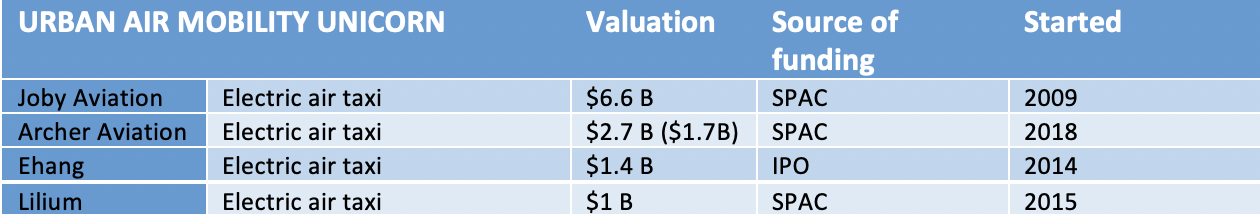

Looking at the 26* startups mentioned below, 13 are connected closely to space, but 11 are classified as aviation companies. Though space startups tend to get stronger media coverage, aviation startups are just as hot, showing comparable funding and valuations.

Notably, the way we think about urban mobility and global transportation is changing and rapidly. Aviation is being fundamentally redefined by massive improvements in battery technology, electronics, and autonomy, as well as pressure to become carbon neutral. Evidenced by the major investments Toyota & Hyundai have made in electric vertical take-off and landing (eVTOL) aircraft, it’s likely that the future of cars is in the air.

Liquidity events are happening much faster.

SpaceX was founded roughly 20 years ago, and although still not a public company, private investors have been able to exit and see major profits. Planet started 10 years ago, and similar companies that have achieved $1B valuation were founded in the last five to eight (5–8) years. Relativity Space became a unicorn in four (4) years; Momentus (a Starburst portfolio company) had achieved unicorn status in less than 36 months (mindful there have been developments since).

The implications of this for the venture capital market are enormous. Startups once considered too risky or dismissed as science project investments have been shown to fit within a standard 10-year fund duration — and now even shorter!

Returns are much higher.

As valuations continue to soar, with companies like Virgin Galactic seeing valuations of not $1B but $8B, it is possible for early-stage investors to see returns on the order of 50–150x. Just one aerospace startup in your portfolio assures a return of your fund of at least 5x with liquidity even before the end of a 10-year fund duration.

At Starburst, three (3) portfolio companies will go public in 2021 alone, all achieving the $1B valuation mark, with liquidity in less than four (4) years.

This is just the beginning.

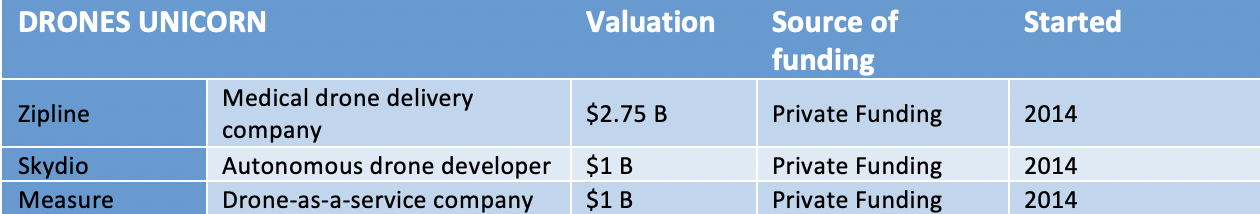

Rocket concepts are improving every month. Satellites are getting smarter, more economical, and development has been slashed from three years to one. Planes are moving faster, with lower emissions, and market pressures driving even Boeing and Airbus to rethink form and function. We will see hydrogen-based mobility companies, like our portfolio company ZeroAvia, join the unicorn club soon. Air taxis will become an integral part of urban mobility, like Craft Aerospace. Drones are delivering packages and heavy freight like Skyways.

This is the future today. The changes in aerospace are linked to developments and opportunities in energy, autonomous ground transportation, communication systems, AI, AR, manufacturing, new materials, and so much more. We are modernizing a global infrastructure and enabling the launch of more ambitious projects and a completely new set of technologies. Change is only going to accelerate and exponential growth in aerospace is now a given.

Here’s to the decade of innovation that we’ve been promised for decades…

* Of the 26 businesses captured in the table, two have undergone new valuations — Momentus at $566m, Archer at $1.7b, and

one has since folded its business— Aerion Supersonic.